Most popular ISA investments funds of 2022

Global stock markets have taken a battering in the last few months. The Nasdaq has dropped by 16% in 2022, while the FTSE 100 has fallen by a more modest 6%. Investors may be seeing their ISA investments starting to dip into the red having only just bounced back from the pandemic.

However, it’s not all bad news for ISA investors as a market downturn can provide the opportunity to invest at lower prices. Laith Khalaf, head of investment analysis at AJ Bell, comments that “All active approaches will go through periods of underperformance, and so investors are absolutely right to look through the short-term noise.”

With three weeks left to use your stocks and shares ISA allowance, I’m going to take a more detailed look at the most popular funds.

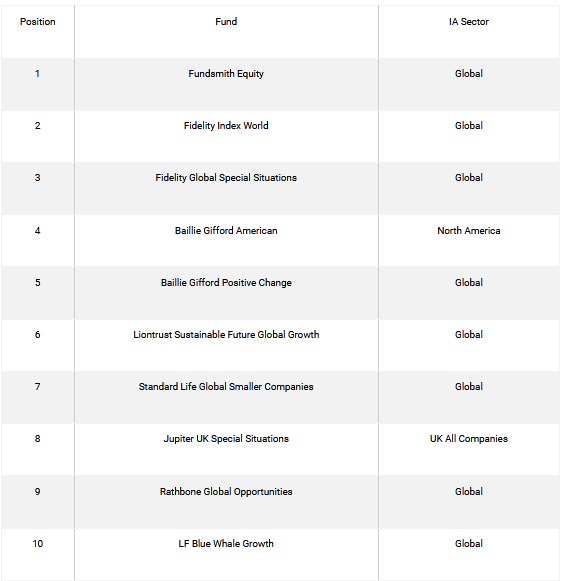

The 10 most-bought ISA funds

According to AJ Bell, these were the most popular ISA funds among their UK clients so far in 2022:

This shows that actively-managed global funds remain popular choices for investors. Laith Khalaf from AJ Bell reports that “Growth investing may have suffered a setback in global markets, but it still remains popular with DIY ISA investors, with Baillie Gifford continuing to capture investor flows, and Blue Whale Growth joining the top ten party too.”

In addition, he notes that “ESG funds also appear to be making more in-roads than last year,” with Liontrust Sustainable and Baillie Gifford Positive Change making the top 10.

What can we learn about the 5 most popular funds?

1. Fundsmith Equity

Laith Khalaf points to investors “keeping the faith” with Fundsmith Equity, despite its recent weak performance. Its veteran manager, Terry Smith, has delivered a five-year return of 71% for investors, comfortably beating the average IA Global sector return of 47%, according to Trustnet.

However, it fell by 13% over January and February, compared to a 7% fall in the MSCI World Index. Tracy Zhao, senior fund analyst at Interactive Investor, suggests that the current market sell-off could provide a buying opportunity for long-term ISA investors. She notes that over half of the portfolio is invested in defensive stocks that “tend to manoeuvre better in an inflationary environment.”

2. Fidelity Index World

Fidelity Index World is the only index fund in the top 10. It tracks the MSCI World Index and charges a low annual management fee of 0.12%.

According to Trustnet, it’s achieved a five-year return of 58%, beating 80% of the global sector funds. With a 10% fall in the last three months, Fidelity Index World offers ISA investors a low-fee option of buying into the stock market recovery.

3. Fidelity Global Special Situations

Fidelity Global Special Situations has delivered a second-quartile return of 54% over the last five years, based on data from Trustnet. It’s also been hit by the sell-off of US tech stocks, falling by 10% in the last three months.

With its largest holdings in Microsoft, Apple, Alphabet and Amazon, investors in this fund will be hoping for a recovery in technology stocks. Bhavik Parekh from Morningstar comments that the gold-rated manager has “proved adept at delivering strong returns through a variety of market conditions.”

4. Baillie Gifford American

Baillie Gifford American had a particularly successful 2020, achieving a 122% return according to Trustnet. But it’s had a similar fall from grace as the other funds, with a 28% loss in the year to date.

Kyle Caldwell from Interactive Investor attributes this to “value shares’ return to favour not helping matters” given the fund’s focus on growth companies. It remains popular with ISA investors due to its strong track record, having achieved one of the highest five-year returns in its sector at 133%.

5. Baillie Gifford Positive Change

This is the only ESG fund in the top five. It aims to invest in companies making a ‘positive change’ to society or the environment. However, ethical investing certainly hasn’t compromised its performance. It’s delivered a five-year return of 174% based on data from Trustnet.

But it’s been hammered in the last six months, with Morningstar reporting a 30% loss compared to a 15% average fall in the sector. It seems that investors view the fund’s current price as a good time to buy for their ISA.

Trying to choose an ISA provider?

Using your stocks and shares ISA allowance is a tax-efficient way of investing in funds. To help you compare the different ISA providers, we’ve produced a list of our top-rated providers of stocks and shares ISAs based on our experts’ extensive research of the market.

Right now, this ‘screaming BUY’ stock is trading at a steep discount from its IPO price, but it looks like the sky is the limit in the years ahead.

Because this North American company is the clear leader in its field which is estimated to be worth US$261 BILLION by 2025.

The Motley Fool UK analyst team has just published a comprehensive report that shows you exactly why we believe it has so much upside potential.

But I warn you, you’ll need to act quickly, given how fast this ‘Monster IPO’ is already moving.

If you want to know more about latest news on Crypto, Blockchain and Bitcoin Visit The Daily Encrypt