The push to explore fossil fuels alternatives is heating up fast. And with the latest US Energy Information Administration report stating that oil barrel prices could trend well over the $100 throughout 2022, I think this will only get stronger. Shrewd investors have been investing in renewable energy shares for some time now. And the current political climate has amplified its prominence manifold. Although there are some exciting options, one renewable energy share stands out as the best option for my portfolio when it comes to scope and recent financials.

Shifting winds

Greencoat UK Wind (LSE: UKW) has been on my FTSE 250 watchlist for a while now. And right now, it looks like the best renewable energy share for me. In recent times, market interest in this company has been immense. With its share price up 8.2% in the last month, the company has gained a lot of prominence since the Russian invasion of Ukraine. But I think this is more than just a reflex reaction to rising oil prices.

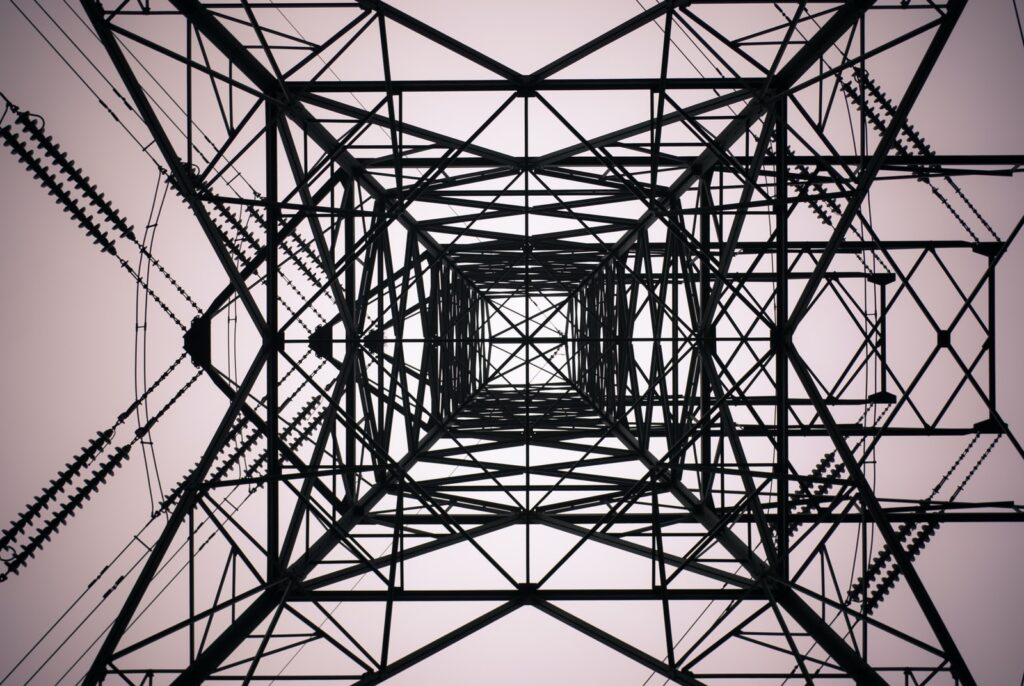

To understand the company’s mission, let us first look at UK’s overall offshore wind energy generation stats. The UK currently has 14GW (gigawatts) of offshore wind assets, of which 10.4GW is operational. While being one of the largest offshore wind energy producers in the world, the country has sanctioned more offshore projects capable of generating nearly 40GW, which could power over 10m homes in the country in the coming years.

And Greencoat could benefit immensely from this. The investment trust owns and operates wind farms and has been rapidly expanding its offshore portfolio. It currently has 43 wind farm investments across England, Scotland, Wales and Northern Ireland. Of this, 30% are offshore assets that are set to grow to 40% this year.

While expansion operations are underway, the company is earning a tidy profit from selling the energy it produces. Rather than speculate on rising stars, Greencoat is a stable business that has shareholder earnings in mind. The company is dividend-focused and the board has plans to increase its 4.73% yield in line with retail price index (RPI) inflation. And in times of heavy inflation, this is a bonus. And thanks to green energy grants, the company operates on strong margins which allowed it to generate £257m cash last year.

Concerns

While offshore farms generally generate more electricity than farms on land, they are also expensive to set up and maintain. And Greencoat’s push to increase offshore assets could eat into its cash reserves. This could also affect its dividend plan in the long run. And the pressure to increase output could put a strain on the industry. And I will be watching developments in this space closely in the coming months

Despite the concerns, Greencoat still looks like the best renewable energy share for my portfolio given the dividend policy, strong balance sheet, and expansion plans. And while its current price of 151p, at a price-to-earnings ratio of 8.3 times, is attractive, I think I will wait for a correction this year before investing.

The post Is this the best UK renewable energy share to buy right now? appeared first on The Motley Fool UK.

Our 5 Top Shares for the New “Green Industrial Revolution”

It was released in November 2020, and make no mistake:

It’s happening.

The UK Government’s 10-point plan for a new “Green Industrial Revolution.”

PriceWaterhouse Coopers believes this trend will cost £400billion…

…That’s just here in Britain over the next 10 years.

Worldwide, the Green Industrial Revolution could be worth TRILLIONS.

It’s why I’m urging all investors to read this special presentation carefully, and learn how you can uncover the 5 companies that we believe are poised to profit from this gargantuan trend ahead!

Access this special “Green Industrial Revolution” presentation now

More reading

My top renewable energy share to buy today

Suraj Radhakrishnan has no position in any of the shares mentioned. The Motley Fool UK has recommended Greencoat UK Wind. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.