I think that one of the best ways to build a passive income stream is through investing in dividend stocks. Many companies pay shareholders some of the profit they make in a given year and this payment is called a dividend.

The average dividend yield for the FTSE 100 right now is 4.1%. I believe this is a decent amount to use when determining the UK stock market’s ability to provide passive income through shareholder dividends.

Average yields

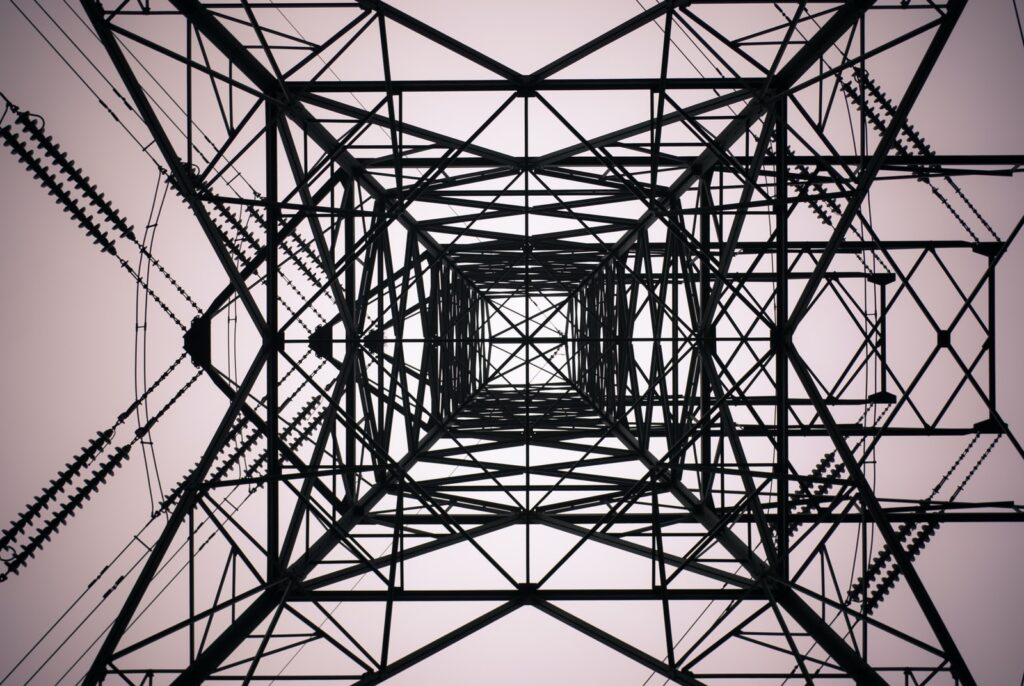

The Footsie’s average yield fluctuates as the companies in it adjust their payments to fit their financial situations and as share prices change. Sometimes the yields can go up, but they can also go down. However, several UK firms pay more than the average of the FTSE 100 index. As I write, Rio Tinto, the major mining firm, has a dividend yield of just over 9.8%. National Grid, the utility focusing on electricity, estimates a yield of around 4.6%. Vodafone, the telecommunications company, is paying roughly 5.9%.

These numbers are all higher than the FTSE average. But it’s worth remembering that no company is under obligation to issue a dividend and may be forced to cancel them in extreme circumstances. The covid-19 pandemic forced lots of UK companies to do this in 2020.

Pay attention and diversify

Different industries make money in different ways. Some can be expected to be steady earners all year round. Others, like mining and commodities, can be more cyclical. For companies like these, dividends might come and go. But that doesn’t rule out the possibility of me investing in cyclical stocks. It simply means that I must choose the right moments to invest and keep a close check on my equities while they are held.

Natural resources stocks are attractive to me right now, so I’m interested in companies like Glencore, Anglo American, and BP. However, when it comes to a dividend-driven investment plan, I believe that diversification across sectors is very important. I know that these industries probably won’t be booming so much in the future. So defensive stocks like Imperial Brands, Tate & Lyle, and some others highlighted in this article would also be on my radar.

High-dividend stocks tend to have other valuable qualities as well, which is one of their greatest advantages. And one hypothesis I’m following right now is that in the next bull market, firms with strong value characteristics would likely lead the charge upward.

After all, it’s difficult to dispute that growth stocks with high valuations have recently seen significant losses. And it might indicate that they’ve had their moment in the spotlight for the time being, and possibly for years to come.

£1,000 per month in dividends

To earn £1,000 each month in dividends, I would need a portfolio worth around £300k. At 4.1% I could potentially receive £12,000 in yearly dividend income. Building a portfolio of this size will require careful planning, saving and investing over many years. But it’s not impossible. By starting to invest today, focusing on the long term, and reinvesting the dividends I earn along the way, I could reach that goal much sooner than by simply saving.

The post How I plan to use investing to earn £1,000 a month in passive income appeared first on The Motley Fool UK.

Inflation Is Coming: 3 Shares To Try And Hedge Against Rising Prices

Make no mistake… inflation is coming.

Some people are running scared, but there’s one thing we believe we should avoid doing at all costs when inflation hits… and that’s doing nothing.

Money that just sits in the bank can often lose value each and every year. But to savvy savers and investors, where to consider putting their money is the million-dollar question.

That’s why we’ve put together a brand-new special report that uncovers 3 of our top UK and US share ideas to try and best hedge against inflation…

…because no matter what the economy is doing, a savvy investor will want their money working for them, inflation or not!

Best of all, we’re giving this report away completely FREE today!

Simply click here, enter your email address, and we’ll send it to you right away.

More reading

What’s going on with the NIO share price?

3 dirt-cheap FTSE 100 shares I’d buy for powerful passive income

2 cheap UK shares that fit Warren Buffett’s investment style

Has the BAE share price reached its peak?

The Stocks and Shares ISA deadline is almost here. How would I invest £20k?

James Reynolds has no position in any of the shares mentioned. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.