Setting a substantial passive income goal and figuring how to achieve it can feel rewarding. Once the income hopefully starts flowing in, it could be rewarding financially too.

If I wanted to target £5,000 in passive income next year — and hopefully in the years that follow — I would do it by investing equally in the five UK shares below. Their average yield is 7.3%, so to hit my annual target of £5,000 in passive income I would need to invest around £68,500. If I had a smaller amount I wanted to invest, I could still target the same average yield by buying these five shares for my portfolio. But with less money invested, my passive income would also be reduced accordingly.

Legal & General

Insurer and financial services group Legal & General (LSE: LGEN) has a yield of 6.5%. There are other financial services groups with a higher yield, but there are a couple of reasons I would choose Legal & General specifically for my portfolio. First, it has proven to be committed to its dividend. For example, during the pandemic when many peers suspended their payouts, Legal & General kept its dividend. I also think the company’s marketing concept of “Inclusive Capitalism” shows that it is thinking hard about how to maintain its commercial relevance even after over 180 years in business.

Dividend history is not necessarily a guide to what will come in future. Although the company has set out a plan that anticipates increasing its payout annually in coming years, dividends are never guaranteed. Legal & General does face risks. Its marketing push is a reminder of how competitive the financial services market is. Fierce competition could mean lower profit margins in the future than in the past.

But I think the company has some important strengths too. Its famous multi-coloured umbrella logo has given the firm lasting awareness in the minds of millions of potential customers. Its investment management business also helps bring more diversity to its activities, giving it wider growth opportunities than some pure play insurers.

National Grid

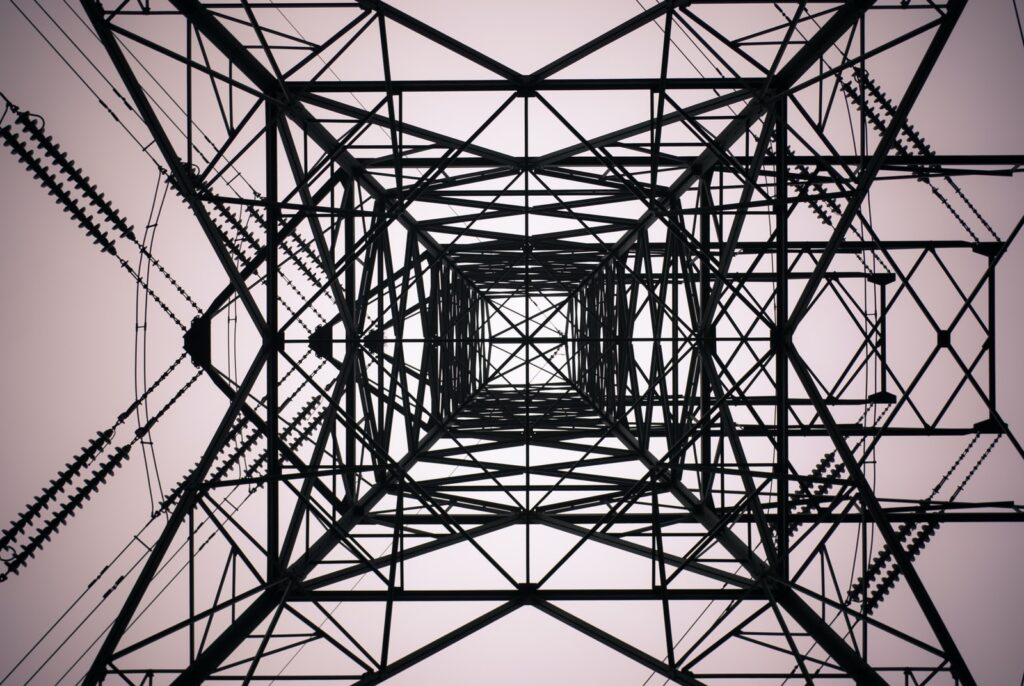

It takes a lot of time and money to build an electricity distribution network. That is why such networks often have no competition. That can be good for profits, especially as electricity is an essential part of daily life and demand tends to be robust.

UK utility National Grid is a dividend share I would add to my portfolio to benefit from this. It can be rewarding in terms of passive income, offering a 4.5% yield. National Grid has been a consistent dividend raiser in recent years. There are risks, such as a shift in patterns of electricity consumption as hybrid working takes root. That could require capital expenditure to update the network, eating into profits. But I see National Grid as a classic utility share, with long-term business potential and an attractive dividend.

M&G

Investment manager M&G (LSE: MNG) sometimes looks unloved by investors. The M&G share price has increased 8% over the past year, in line with the FTSE 100. But its dividend yield is 8.9%, which is unusually high for a FTSE 100 member.

Does that suggest investors have doubts about the sustainability of the dividend? After all, the company has plainly stated that it plans to maintain or increase it – and yields close to 9% are rare. Or could it be that the City has never properly understood the M&G business since it demerged from Prudential several years ago to become a standalone listed company?

I think both things could be true. Although management does not plan to cut the dividend, payouts are never guaranteed. M&G does face risks, including the risk of client outflows hurting revenues and profits. In its first half, such outflows continued in the retail asset management arm. But the institutional arm saw net inflows and reached a record amount of assets under management. The scale of its assets under management and its M&G’s established reputation make me think it can be a lucrative business over the long term. Whether it is popular or not, I like the income generation potential of M&G. I would consider adding it to my passive income portfolio.

Passive income ideas in tobacco

Tobacco shares are common passive income ideas. That is partly because of the high yields on offer. But while tobacco shares are higher-yielding than much of the market, they still yield less than shares in sectors such as mining. So why do I consider tobacco shares as some of my most rewarding passive income ideas? It is because of the economic characteristics of the tobacco industry. Production costs are low. But the addictive nature of the product and the power of premium tobacco brands mean that the products can be sold for a big profit. Unlike mining, for example, the demand for tobacco tends to be fairly stable from year to year.

British American Tobacco

In the longer term, however, the demand picture becomes less clear. Cigarette use is in structural decline in most developed markets. That will reduce revenues for manufacturers. Pricing power may offset some of the fall in profits, but in the long term, markedly lower revenues will hit profits at some stage.

Lucky Strikes maker British American Tobacco actually saw cigarette revenue rise last year, due in part to price increases. I think its vast cigarette business will generate substantial cash flows for years to come. But it is also expanding into new product categories to try and diversify its business. It expects those new areas to become profitable in 2025. This month it raised its dividend as it has annually for over 20 years. The current yield is 6.6%. I would happily hold it in my passive income portfolio.

Income & Growth Venture Capital Trust

The fifth pick for my portfolio would be Income & Growth Venture Capital Trust. The trust invests in a portfolio of up and coming companies, many of which are not listed on a stock market.

That gives me exposure to a broad range of emerging businesses. If the trust managers choose their investments well, they can generate income that is passed on to shareholders as a dividend. That might not happen: many early stage companies fail and that could hurt profits at the trust. But when it does work, it can be rewarding. Currently, the trust yields 9.8%. That would make a very tasty addition to my passive income portfolio.

The post 5 shares I’d buy now to target £5,000 in passive income next year appeared first on The Motley Fool UK.

Our 5 Top Shares for the New “Green Industrial Revolution”

It was released in November 2020, and make no mistake:

It’s happening.

The UK Government’s 10-point plan for a new “Green Industrial Revolution.”

PriceWaterhouse Coopers believes this trend will cost £400billion…

…That’s just here in Britain over the next 10 years.

Worldwide, the Green Industrial Revolution could be worth TRILLIONS.

It’s why I’m urging all investors to read this special presentation carefully, and learn how you can uncover the 5 companies that we believe are poised to profit from this gargantuan trend ahead!

Access this special “Green Industrial Revolution” presentation now

More reading

2 of my best dividend stocks to buy now

2 UK dividend stocks I’d invest a spare £250 in today

2 FTSE 100 stocks I’d buy before the ISA deadline for a starter portfolio

7.1% and 5% dividend yields! 2 of the best cheap dividend shares to buy today

A ‘rock-solid’ FTSE 100 company with an 8.5% dividend yield

Christopher Ruane owns shares in British American Tobacco. The Motley Fool UK has recommended British American Tobacco and Prudential. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.